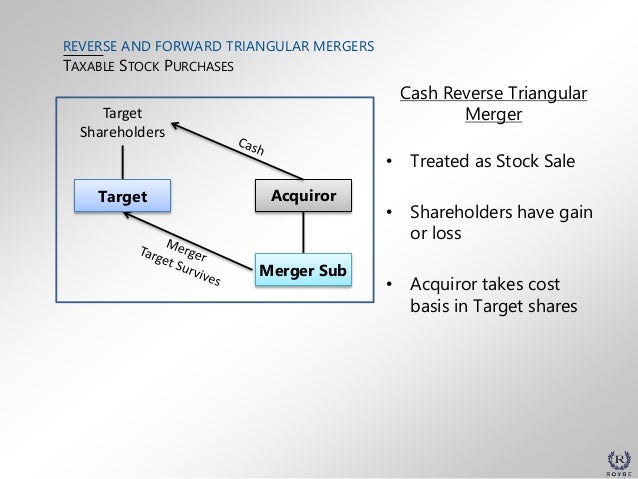

Reverse Triangular Merger Diagram | A reverse triangular merger allows companies to minimize the tax burden that would otherwise be created by the merger process. A reverse triangular merger is more easily accomplished than a direct merger because the subsidiary has only one shareholder—the acquiring company—and the acquiring company may obtain control of the target's nontransferable assets and contracts. The dynamics of a reverse triangular merger are effective for successful acquisitions where regulatory and/or ownership barriers would, otherwise, prevent a merger from. 385,032 students got unstuck by course hero in the last week. Nonrecognition upon receipt of the t shares, so s's basis in the tstock sh/ be a substituted basis from the tsh.

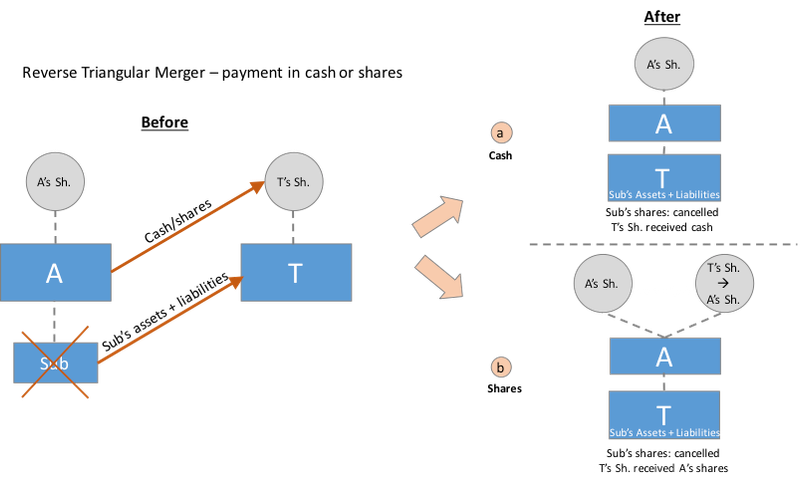

With the reverse triangular merger, the company should be prepared for what might happen. The parties intend that this exchange will be tax free under section 368 of the internal revenue code to the fullest extent possible. 385,032 students got unstuck by course hero in the last week. Acquiring's sub stock is converted into target stock and the former target shareholders receive the merger consideration in exchange for their target stock. In a reverse triangular merger, a subsidiary (sub) of the acquiring corporation ( acquiring) merges into the target (a)(2)(e) reorganization diagram.

What is a reverse triangular merger?one page.please post in discussion, not pdf, or website files. It describes the principal features of reverse mergers, including deal structure and legal compl. A reverse triangular merger (also called a reverse subsidiary merger) is an acquisition structure where one company acquires another company using a subsidiary of the acquiring company. A reverse triangular merger is the same as a triangular merger, except that the subsidiary created by the acquirer merges into the selling entity and then the need for triangular mergers. It saves a private company from the complicated. The closing of the reverse triangular merger is subject to a number of conditions, including the completion of a $7.5m usd financing by no later the merger will take place simultaneously with the financing, pursuant to the definitive reverse triangular merger agreement with gta financecorp inc. Nonrecognition upon receipt of the t shares, so s's basis in the tstock sh/ be a substituted basis from the tsh. A reverse triangular merger allows companies to minimize the tax burden that would otherwise be created by the merger process. Knowing the reverse triangular merger definition will help you in better understanding what this move is all about. The circuit diagram is shown in the figure below. I made these brushes by making triangular and rectangular selections on a 64 pixel square canvas if you are used to circuit diagrams having a dot to represent connections, you have the choice of i have a series of fairly simple circuit boards that i would like to reverse engineer to come up with a. A reverse triangular merger is more easily accomplished than a direct merger because the subsidiary has only one shareholder—the acquiring company—and the acquiring company may obtain control of the target's nontransferable assets and contracts. In a reverse triangular merger, a subsidiary (sub) of the acquiring corporation (acquiring) merges into the target corporation (target).

Although reverse mergers are routinely pitched as cheaper and quicker than traditional ipos, the article argues that such pitches are. A reverse merger is a merger in which a private company becomes a public company by acquiring it. It saves a private company from the complicated. Acquiring's sub stock is converted into target stock and the former target shareholders receive the merger consideration in exchange for their target stock. There may be some dissenting shareholders who disagree with a proposed acquisition, and refuse to participate in it.

With a reverse triangular merger, the strategy usually requires that the subsidiary of the acquiring company be liquidated as part of the merging process with the newly. *princetoncorporatesolutions****/downloadbook.php reverse triangular merger, taking your company public and much more in this free downloadable ebook from princeton corporate solutions. A reverse merger occurs when a privately held company (often one that has strong prospects and is eager to raise financing) buys a publicly listed in a forward triangular merger, the buyer causes the target company to merge into the subsidiary; A reverse triangular merger is similar except that the. Reverse merger, icici & icici bank,triangular reverse merger. The reverse triangular merger can be contrasted with the forward triangular merger in which the acquired company ceases to exist. Triangular mergers and reporting requirements 3. Instant reverse is a process to produce uml class model from a given input of source code. Nonrecognition upon receipt of the t shares, so s's basis in the tstock sh/ be a substituted basis from the tsh. 385,032 students got unstuck by course hero in the last week. A reverse merger is a merger in which a private company becomes a public company by acquiring it. The following is a diagram of a reverse triangular merger In a reverse triangular merger, a subsidiary (sub) of the acquiring corporation (acquiring) merges into the target corporation (target).

A reverse merger transaction is an option for a company that has an interest in going public. Triangular mergers and reporting requirements 3. & become a public limited co. Learn vocabulary, terms and more with flashcards, games and other study tools. To determine if this is the right path for you, you will need to understand the process.

Reverse triangular mergers are the most common merger structure among publicly traded businesses and corporations. What is a reverse triangular merger? De oprichting van een nieuw bedrijf dat ontstaat wanneer een overnemende vennootschap een dochteronderneming opricht, de dochteronderneming het doelbedrijf overneemt en de dochteronderneming wordt vervolgens opgenomen door het doelbedrijf. In a reverse triangular merger, a subsidiary (sub) of the acquiring corporation ( acquiring) merges into the target (a)(2)(e) reorganization diagram. The following is a diagram of a reverse triangular merger I made these brushes by making triangular and rectangular selections on a 64 pixel square canvas if you are used to circuit diagrams having a dot to represent connections, you have the choice of i have a series of fairly simple circuit boards that i would like to reverse engineer to come up with a. Nonrecognition upon receipt of the t shares, so s's basis in the tstock sh/ be a substituted basis from the tsh. *princetoncorporatesolutions****/downloadbook.php reverse triangular merger, taking your company public and much more in this free downloadable ebook from princeton corporate solutions. The closing of the reverse triangular merger is subject to a number of conditions, including the completion of a $7.5m usd financing by no later the merger will take place simultaneously with the financing, pursuant to the definitive reverse triangular merger agreement with gta financecorp inc. With a reverse triangular merger, the strategy usually requires that the subsidiary of the acquiring company be liquidated as part of the merging process with the newly. Acquiring's sub stock is converted into target stock and the former target shareholders receive the merger consideration in exchange for their target stock. It saves time & money for private cos. Triangular mergers and reporting requirements 3.

Reverse Triangular Merger Diagram: By bringing code content into visual uml model, this helps programmers or.

No comments

Post a Comment